Red Alert: Is The World Ready For What Happens Next In The Global Financial Crisis?

London, UK - 5th August 2011, 00:10 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors are not necessarily representative of the views of ATCA, which is neutral. ATCA conducts collective Socratic dialogue on global opportunities and threats.]

Global financial markets are now falling off a cliff just as our briefing from one week ago had suggested that they would: "Amber Alert: Is A New Phase In The Global Financial Crisis Imminent?" The scale, speed and synchronicity of the decline are bringing back scary memories of previous phases of the global financial crisis that began in August 2007 and amplified in September 2008. Our deep research and advanced scenario simulations suggest the following interlinked challenges:

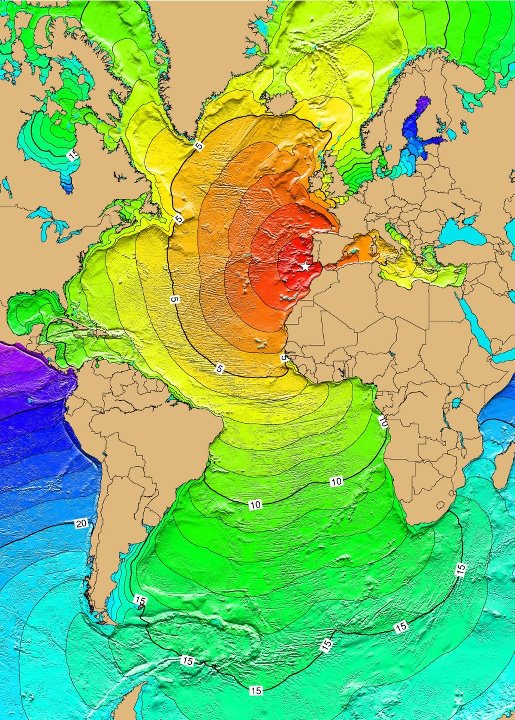

Red Alert: Mid-Atlantic?

Red Alert: Mid-Atlantic?

American Challenges

. The official US economic growth data suggests an economy near stall speed in the first half of the year. Given that the US Congress debt deal comes with drastic spending cuts in an economy already sluggish, how likely is it that this new deal will tip the US and global economy back into recession? If so, is the world ready for another American recession?

. With world trade growth sluggish and inventories rising, world production growing faster than consumption, what will be the consequences for global deleveraging and deflation? Does today's inflation turn to next year's deflation? If QE3 or Quantitative Easing round three is deployed by the US Federal Reserve, how effective will it be given that QE2 was much less effective than QE1? What can and what will President Obama and the US Congress be able to do next?

European Challenges

. The President of the European Commission, Jose Manuel Barroso, has warned that the euro zone's debt crisis is spreading beyond the region's periphery. Is the euro zone on the verge of a Lehman Brothers type of systemic risk? The President's letter urges European Union leaders to make "a rapid reassessment of all elements" related to the euro zone's bailout fund. However, does Europe have the appropriate leadership and financial wherewithal to be able to respond?

. The adverse developments in the euro zone come amid widespread fears that the debt crisis is drawing in big debt-laden economies like Italy and Spain, following bailouts for peripheral euro zone nation states like Greece, Ireland and Portugal. France too is being warned by the IMF and others that it could be sucked into the crisis. How large is the scale and scope of this crisis and do European powers have the capability, capacity and architecture to cope?

. Which euro zone peripheral countries including the PIIGS -- Portugal, Ireland, Italy, Greece and Spain -- are now likely to default? If so, how big will the bond holders' haircuts be? Can European leaders overcome historical resistance to greater fiscal, monetary and political union? What are the consequences of a potential dissolution of the euro zone?

International Challenges

. Does the turmoil in Europe and the US reflect global slowdown and trading damage to the emerging market economies including China, India, Brazil and Russia? Will national responses to the global slowdown result in another round of currency wars? Is any economy insulated from the global financial markets downward plunge?

. As banks begin being reluctant to lend to each other, when will they become reluctant to lend to their customers? As unemployment rises and consumers struggle to repay their loans, bad debts mount, and house prices continue to fall, what will be the combined impact of these developments on consumer spending? Are there any tools left in the fiscal and monetary tool box that could prove to be effective in stimulating growth? Is there anything likely to turn the global economy towards growth once again?

. Given extreme correlation between all asset classes regardless of geography including equities, commodities, corporate bonds, will they all fall together while the US dollar strengthens in inverse correlation? Will falling oil and commodity prices have a dampening effect on the rate of decline of global financial markets?

What Next?

Given these complex interlinked challenges, which asset allocation strategies and wealth management techniques ought to be deployed by individuals, institutions and governments to mitigate financial losses caused by extreme market turmoil and decline? Are there any asymmetric opportunities which this sequence of scenarios presents to savvy investment players?

[STOPS]

We are hosting an Expert roundtable on this issue at ATCA 24/7 on Yammer.

[ENDS]

Expert Roundtables

Expert roundtables are the newly launched ATCA 24/7 Q&A private exclusive club service. They seek to become the killer application in strategic intelligence by delivering an unprecedented competitive advantage to our distinguished members. They can only be accessed online at https://www.yammer.com/atca

Q1: How to become a privileged member of ATCA 24/7 to participate in the expert roundtables?

A1: i. If you are a distinguished member of ATCA 5000, ATCA Open, The Philanthropia or HQR affiliated groups you may be allowed to become a privileged member of this new and exclusive private club.

ii. If you are pre-invited, visit the private intelligence network -- PIN -- by going to https://www.yammer.com/atca [Note: In https:// 's' is for security and encryption]

iii. If you don't have membership of the PIN yet, email the mi2g Intelligence Unit at intelligence.unit at mi2g dot com for an exclusive invitation.

Q2: How to participate in the expert roundtables and get domain-specific strategic intelligence questions answered?

A2: Access the ATCA 24/7 Private Intelligence Network -- PIN -- online and ask or answer a strategic intelligence question, no matter how complex. Receive expert answers within 24 hours or get pointers from:

i. ATCA 5000 experts who are online;

ii. ATCA Research and Analysis Wing; and

iii. mi2g Intelligence Unit.

Q3: Why is the ATCA 24/7 Q&A Exclusive Club special?

A3: ATCA 24/7 has now created an exclusive private intelligence watering hole and expert roundtable at the highest level where interesting and sophisticated questions are being asked from around the world, and intelligent answers are being provided, almost always by experts who have deep domain-specific knowledge. Come and check out the exclusive club, take it for a strategic test drive, which sign-of-intelligent life are you waiting for?

To learn more about "The Expert Roundtable: ATCA 24/7 Q&A Club" email: intelligence.unit at mi2g.com and if you are already a member visit https://www.yammer.com/atca

We welcome your thoughts, observations and views. To reflect further on this subject and others, please respond within Twitter, Facebook and LinkedIn's ATCA Open and related discussion platform of HQR. Should you wish to connect directly with real time Twitter feeds, please click as appropriate:

. ATCA Open

. @G140

. mi2g Intelligence Unit

. Open HQR

. DK Matai

Best wishes