Italy Enters Danger Zone?

London, UK - 9th November 2011, 9:05 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors are not necessarily representative of the views of ATCA, which is neutral. ATCA conducts collective Socratic dialogue on global opportunities and threats.]

1. Equity markets euphoria notwithstanding, Italy could yet drag the Eurozone and world financial markets into a new and formidable out-of-control crisis;

2. Even if Berlusconi goes, it is unlikely that any parliamentary consensus will emerge in the short term to cut Italy's massive debt and boost growth;

3. There is no agreement amongst the political parties on either a national unity or technocrat government to get Italy out of the mess it finds itself in;

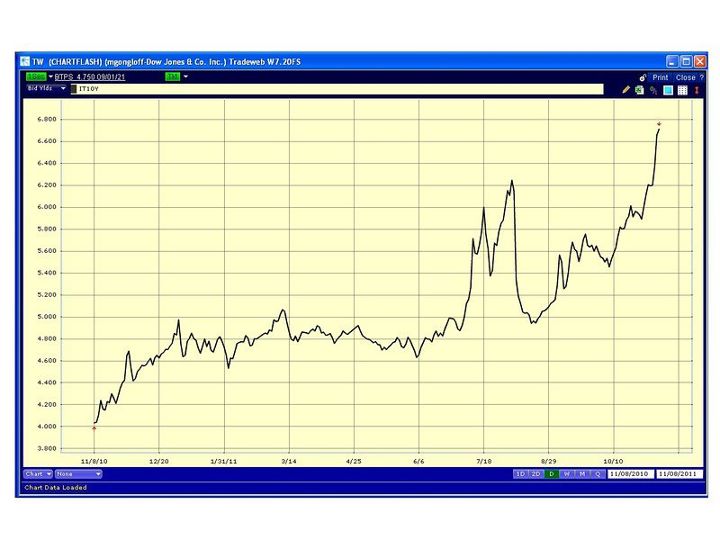

Italian 10-year bond yields

Italian 10-year bond yields

4. Yields on Italy's 10-year benchmark government bonds spiked close to 7 percent on Tuesday, a sign that markets are questioning the country's ability to service and pay its debt;

5. The spike in Italian bond yields resulted in a spread of almost 500 basis points to German bunds;

6. Italy's government debt bond market is the third biggest in the world, behind the US and Japan;

7. Italy is reaching the point where Greece, Ireland and Portugal were forced to seek a bailout from the IMF and EU;

8. Increased European Central Bank (ECB) bond buying, albeit within a limit, has so far failed to halt the spike in Italian bonds yields;

9. Italian bond yields are now at that dangerously elevated level from which no other Eurozone government bond market has ever recovered;

10. Unlike Greece, Ireland or Portugal -- all of which received financial lifelines -- Italy has too much government debt of nearly two trillion euros -- to be rescued by its European neighbours;

11. Given the Eurozone's inadequate bailout facilities, many argue only an unlimited ECB commitment to buy Italian bonds can prevent the debt crisis spiralling out of control;

12. ECB has repeatedly said it has no mandate to act as lender of last resort to countries. To do so would break European law;

13. New ECB President Mario Draghi has stressed the ECB's bond buying is limited and temporary; and

14. Italy has the third-biggest economy in the eurozone and its debt worries are a huge threat in the wider crisis facing Europe's single currency.

Conclusion

Bond market yields can cross a point of irreversibility and after breaching that point-of-no-return, the cascade of selling accelerates. Has Italy entered that danger zone?

[STOPS]

What are your thoughts, observations and views? We are hosting an Expert roundtable on this issue at ATCA 24/7 on Yammer.

[ENDS]

Expert Roundtables

Expert roundtables are the newly launched ATCA 24/7 Q&A private exclusive club service. They seek to become the killer application in strategic intelligence by delivering an unprecedented competitive advantage to our distinguished members. They can only be accessed online at https://www.yammer.com/atca

Q1: How to become a privileged member of ATCA 24/7 to participate in the expert roundtables?

A1: i. If you are a distinguished member of ATCA 5000, ATCA Open, The Philanthropia or HQR affiliated groups you may be allowed to become a privileged member of this new and exclusive private club.

ii. If you are pre-invited, visit the private intelligence network -- PIN -- by going to https://www.yammer.com/atca [Note: In https:// 's' is for security and encryption]

iii. If you don't have membership of the PIN yet, email the mi2g Intelligence Unit at intelligence.unit at mi2g dot com for an exclusive invitation.

Q2: How to participate in the expert roundtables and get domain-specific strategic intelligence questions answered?

A2: Access the ATCA 24/7 Private Intelligence Network -- PIN -- online and ask or answer a strategic intelligence question, no matter how complex. Receive expert answers within 24 hours or get pointers from:

i. ATCA 5000 experts who are online;

ii. ATCA Research and Analysis Wing; and

iii. mi2g Intelligence Unit.

Q3: Why is the ATCA 24/7 Q&A Exclusive Club special?

A3: ATCA 24/7 has now created an exclusive private intelligence watering hole and expert roundtable at the highest level where interesting and sophisticated questions are being asked from around the world, and intelligent answers are being provided, almost always by experts who have deep domain-specific knowledge. Come and check out the exclusive club, take it for a strategic test drive, which sign-of-intelligent life are you waiting for?

To learn more about "The Expert Roundtable: ATCA 24/7 Q&A Club" email: intelligence.unit at mi2g.com and if you are already a member visit https://www.yammer.com/atca

We welcome your thoughts, observations and views. To reflect further on this subject and others, please respond within Twitter, Facebook and LinkedIn's ATCA Open and related discussion platform of HQR. Should you wish to connect directly with real time Twitter feeds, please click as appropriate:

. ATCA Open

. @G140

. mi2g Intelligence Unit

. Open HQR

. DK Matai

Best wishes