European Bankers & Top Politicians Fear Collapse of the Euro: Flight-of-Capital and Silent Bank Runs

London, UK - 10th August 2012, 23:20 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors are not necessarily representative of the views of ATCA, which is neutral. ATCA conducts collective Socratic dialogue on global opportunities and threats.]

Until recently, it was a sign of political correctness not even to consider the possibility of a euro collapse. Investment experts at Deutsche Bank -- Germany's largest bank -- now feel that a collapse of the common currency is "a very likely scenario." Germany's second-largest bank -- Commerzbank -- has also flagged fears of a Eurozone collapse whilst bracing for a worsening of the euro-crisis. "The greatest downside risk remains an uncertainty shock from an escalation of the sovereign debt crisis, ie, the collapse of the monetary union," Commerzbank states in its latest quarterly report released this week, adding that it thought the risk was higher now than in autumn last year. Italian Prime Minister Mario Monti has also warned of the “psychological break-up” of Europe if the euro crisis is not soon resolved. Spain and Italy, the two chief trouble spots, are threatened with a financial collapse that could tear the 13-year-old currency union apart and rock the global economy. The World Bank has also warned that the euro collapse could spark a global crisis. It isn't easy to predict how such a tornado would affect the global economy, but it's clear that the damage would be immense.

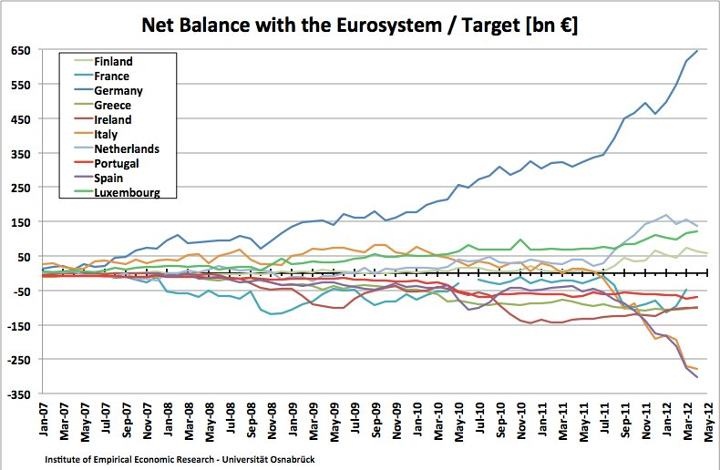

The Net Balance of Inflows and Outflows of Capital in Eurozone Countries: Emphasis Spain & Italy

The Net Balance of Inflows and Outflows of Capital in Eurozone Countries: Emphasis Spain & Italy

Slow... Then Sudden Devaluation?

Is the euro about to fall further, possibly leading to serious concerns about a devaluation spiral of the European single currency? Over the last three months, the euro has lost around 5 percent of its value against a basket of major currencies. Against the US dollar, it has lost around 8 percent. Is there a need for a more clear signal that the Eurozone debt crisis has now reached the global currency markets?

How Big Is the Eurozone 'Flight-of-Capital'?

The amounts involved in the flight of capital from the Eurozone are truly substantial. Silent bank runs are now happening within the eurozone. Up until a few months ago, they were relatively slow and prolonged. In recent months, they have shown signs of accelerating sharply, in a way which demands an urgent response from policy-makers, but nothing substantial is forthcoming. For example, Spain has already suffered 41.3 billion euros of capital flight in May alone, or a total of 163 billion euros in the first half, equivalent to about 16 per cent of its GDP. It is estimated that the Eurozone's total outflow over the coming two years could be between 750 billion and 1.25 trillion US dollars equivalent per annum. Total bank deposits in the Eurozone add up to around 7.6 trillion euros, including 5.9 trillion euros belonging to households. The Eurozone’s peripheral countries, which are the most susceptible to capital flight, have 1.8 trillion euros in household deposits. There are three significant trends to note in regard to the flight of capital from the Eurozone:

1. Foreigners are moving their money out of Eurozone countries because for them even a small risk of devaluation of the euro or sovereign default is not worth taking;

2. Local depositors are moving their money out of more vulnerable Eurozone banks to bigger and stronger banks as well as foreign banks to safeguard against the potential collapse of some banks; and

3. Locals are also moving their money abroad, often from the local branch of a Eurozone bank to an overseas bank outside the Eurozone to stem the extent of their potential losses in the event of a devaluation of the euro.

What Has Caused The Surprising Delay In the Euro's Correction?

What's surprising is that the euro's correction did not happen sooner and was not a great deal more pronounced than what we have witnessed more recently. The answer lies in the three-phase pattern of the now five-year-old global financial crisis.

PHASE - I

1. This is essentially a global debt crisis whose symptoms have been spreading for five years since August 9th, 2007;

2. It all started with the US subprime mortgage sector and associated illiquid assets, quickly spreading to the banking sector;

3. After Lehman Brothers collapsed in September 2008 and large-scale Quantitative Easing was undertaken by the US Federal Reserve in Q1 2009, the crisis jumped into public finances, ie, sovereign debt and has continued to home in on Eurozone sovereign debt as of late 2009;

4. First severe phase of the Eurozone crisis took place between April 2010 and June 2011, when foreign investors pulled back on buying bonds from peripheral countries;

5. Those capital outflows had no adverse impact on the euro’s exchange rate, because they merely represented shifts of capital within the Eurozone; and

6. The general trend was one of substitution from the periphery into the core Eurozone countries, ie Germany, France and the richer north.

PHASE - II

1. The second phase started in July 2011 when tensions spread to Italy and Spain, and this "shock to confidence" was followed by a "sharp change" in investment flows as foreign private investors started cutting exposure not just to Italy and Spain but also to Belgium, France and even Germany;

2. During the second phase, there was substantial -- hundred billion euros type -- offset from Eurozone investor behaviour, as European investors and financial institutions repatriated "sizeable amounts of money" to the single currency area by liquidating their overseas assets to increase cash and to shore up their balance sheets;

3. During the bear market in the second half of 2011, those repatriations gave the appearance of a stronger euro;

4. Although the repatriation was going on, the euro started falling, because the inflows into the Eurozone were insufficient to offset fully the recessionary decline in strong global trade inflows; and

5. As a result, the net deterioration in the value of the euro was much less pronounced than inflow dynamics alone would have suggested, and it played a role in containing euro weakness by making it appear more moderate than many had expected.

PHASE - III

Has The Flight of Capital From The Eurozone Begun?

1. The third phase of the crisis has now begun and it shows a remarkable new element: domestic investors in the Eurozone are starting to "push more money abroad," in a dynamic like the ones we have witnessed in traditional emerging market currency crises like the Asian and Latin American crises.

2. There are several elements pointing to the start of the flight of capital to foreign assets away from the Eurozone:

a. The balance of payments data from the European Central Bank shows outsized foreign fixed income buying by Eurozone investors in the last two quarters;

b. Several consecutive months of data show significant foreign bond buying; and Eurozone investors have also started to invest large amounts in foreign short-dated debt;

c. There has been a structural break in weekly mutual funds trends in recent months, with latest data showing unusually strong buying of foreign bonds, especially US and emerging markets bonds in the last quarter;

d. This is a departure from previous trends, which typically showed repatriation of foreign fixed income assets in bear markets for risky assets;

e. There has been evidence that the Swiss and the Danish national banks intervened "aggressively" in recent months to fend off strong foreign inflows from the Eurozone, while demand for British and Swedish debt has increased notably; and

f. The idea of capital flight into non-euro zone markets from Eurozone investors fits with the price action in global sovereign bond markets. Danish bond yields have seen the largest yield compression in recent history and German, Finnish as well as British government bonds also stand out for their extremely low yields.

Accelerated Capital Flight

In Greece, Ireland, and Portugal, foreign deposits have fallen by an average of half, and foreign government bond holdings by an average of one third, from their peaks.

The same move in Spain and Italy, taking into account the fall that has already taken place, would imply a further 200+ billion to 350+ billion euros in capital flight respectively, skewed towards loss of deposits in the case of Spain and towards the dumping of government bonds in the case of Italy. When we examine portfolio and deposit outflows to-date, what stands out is that it is difficult to divorce Spain and Italy. Spain's banks are in deadly trouble. Their assets and deposit bases are both evaporating. But the government can't afford to bail them out. However, both Spain and Italy have so far experienced outflows that are of a similar magnitude, highlighting that while Spain has been grabbing all the headlines, the market concern is as much focused on Italy.

Several months ago, capital outflows from the peripheral Eurozone countries prompted a worldwide dialogue about the significance of the balances of the European payments system known as Target2, as the euro-system -- particularly the German Bundesbank -- took over the financing of these private capital outflows. Economic deterioration, ratings downgrades and especially a Greek exit would almost certainly significantly accelerate the timescale and increase the amounts of these outflows from the Eurozone, turning the process into a step-by-step stampede.

Lessons from South East Asia

Whilst the Eurozone crisis is much more complicated and likely to be protracted, during the 1997-98 South East Asian financial crisis there was substantial flight of capital from those countries. Residents knew the changing nature of risks and rewards earlier than non-residents. Residents' attempt to be the first ones to exit was subsequently identified as the likely cause for precipitating that crisis. As the capital flight accelerated, in parallel, there was a sudden and palpable loss of confidence throughout South East Asian economies. Is the Eurozone mirroring some of the defining features and significant milestones of the South East Asian financial crisis and collapse?

Conclusion

Public trust in the single European currency is sliding at a dramatic pace. Is the euro coming close to a tipping point when it might devalue more swiftly? Now that the currency dispute has escalated in Europe, the inconceivable is becoming conceivable, at all levels of politics and national economies.

1. Polls show that the general public may be increasingly turning its back on the euro as the national currency across Europe, while confidence in EU policymakers has significantly fallen -- the perception that the EU is “a good thing” has fallen below 50% in Germany, and to about 30% in Italy and Spain.

2. For all intensive purposes the Eurozone crisis has now entered its third phase, that of "Flight-of-Capital" and this will push the euro much lower.

3. There are growing signs with every passing week that the crisis of confidence in the Eurozone is assuming an ever larger new dimension. For some weeks, it has been apparent that capital is no longer simply flowing from the southern countries to the core countries of the Eurozone, particularly Germany, but actually heading offshore.

4. The falling euro is a sign that the Eurozone as a whole is experiencing a net outflow of capital. Whereas initially investors fled to the safety of the Eurozone’s core, now they are taking their capital out of the Eurozone altogether.

5. Domestic and foreign investors seem to be steadily losing confidence in the Economic and Monetary Union, and so are increasingly looking for safe havens for their money outside the Eurozone.

Nothing seems impossible anymore, not even a scenario in which all members of the currency zone dust off their old currencies bidding farewell to the euro, and instead welcome back their historic national currencies.

[STOPS]

What are your thoughts, observations and views? We are hosting an Expert roundtable on this issue at ATCA 24/7 on Yammer.

[ENDS]

Expert Roundtables

Expert roundtables are the newly launched ATCA 24/7 Q&A private exclusive club service. They seek to become the killer application in strategic intelligence by delivering an unprecedented competitive advantage to our distinguished members. They can only be accessed online at https://www.yammer.com/atca

Q1: How to become a privileged member of ATCA 24/7 to participate in the expert roundtables?

A1: i. If you are a distinguished member of ATCA 5000, ATCA Open, The Philanthropia or HQR affiliated groups you may be allowed to become a privileged member of this new and exclusive private club.

ii. If you are pre-invited, visit the private intelligence network -- PIN -- by going to https://www.yammer.com/atca [Note: In https:// 's' is for security and encryption]

iii. If you don't have membership of the PIN yet, email the mi2g Intelligence Unit at intelligence.unit at mi2g dot com for an exclusive invitation.

Q2: How to participate in the expert roundtables and get domain-specific strategic intelligence questions answered?

A2: Access the ATCA 24/7 Private Intelligence Network -- PIN -- online and ask or answer a strategic intelligence question, no matter how complex. Receive expert answers within 24 hours or get pointers from:

i. ATCA 5000 experts who are online;

ii. ATCA Research and Analysis Wing; and

iii. mi2g Intelligence Unit.

Q3: Why is the ATCA 24/7 Q&A Exclusive Club special?

A3: ATCA 24/7 has now created an exclusive private intelligence watering hole and expert roundtable at the highest level where interesting and sophisticated questions are being asked from around the world, and intelligent answers are being provided, almost always by experts who have deep domain-specific knowledge. Come and check out the exclusive club, take it for a strategic test drive, which sign-of-intelligent life are you waiting for?

To learn more about "The Expert Roundtable: ATCA 24/7 Q&A Club" email: intelligence.unit at mi2g.com and if you are already a member visit https://www.yammer.com/atca

We welcome your thoughts, observations and views. To reflect further on this subject and others, please respond within Twitter, Facebook and LinkedIn's ATCA Open and related discussion platform of HQR. Should you wish to connect directly with real time Twitter feeds, please click as appropriate:

. ATCA Open

. @G140

. mi2g Intelligence Unit

. Open HQR

. DK Matai

Best wishes