Swiss Banking: Asymmetric Threats Mount?

London, UK - 13th July 2012, 03:50 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors are not necessarily representative of the views of ATCA, which is neutral. ATCA conducts collective Socratic dialogue on global opportunities and threats.]

'Tis Pride with these old men

To tell what they have seen.

'Twill be Pride, when we are old,

To say that in our youth

We heard the tales they told

And looked on them in their truth!

- Anonymous

Total client assets managed by Swiss banks stood at 5.3 trillion Swiss francs or 5,300 billion Swiss francs at the end of last year according to the latest data compiled by the Swiss Bankers Association (SBA), the apex body of banks in Switzerland. This includes 2,700 billion Swiss francs (51 per cent) of foreign client assets and the remainder 2,600 billion Swiss francs (49 per cent) of domestic client assets. The drop to 51 per cent of total foreign assets-under-management is the lowest recorded in four years. Titled “Banking in transition - Future prospects for banks in Switzerland”, the latest SBA study notes that the share of foreign client assets in the Swiss wealth management industry has fallen for four successive years: from 56% at the end of 2008 to 55% in 2009 to 52% in 2010 and 51% in 2011. The quantum of overseas assets under management at the end of 2008 stood at 3 trillion Swiss francs and this includes the value of securities held in client portfolios, fiduciary deposits, amounts due to clients in savings and investment accounts, and as also from time deposits.

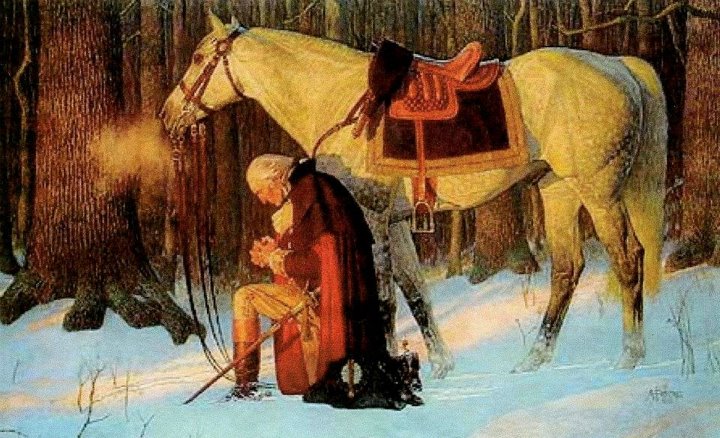

Prayer of Valley Forge, George Washington, Commander-in-Chief, 1st President, USA

Prayer of Valley Forge, George Washington, Commander-in-Chief, 1st President, USA

Why are overseas assets in Switzerland declining?

Foreign clients have traditionally been the mainstay of Swiss banks' wealth management business but growing pressure from foreign governments for action against Swiss banks and their employees for alleged assistance in the hoarding of illicit or untaxed wealth in Switzerland belonging to their citizens has been acting as a dampener in recent years. The decline in foreign client assets has come at a time when Swiss banks are also recording an increased number of complaints from their overseas customers. Hundreds of billions of dollars worth of overseas funds originally kept in Switzerland have been voluntarily despatched in recent years to secret or brown-box accounts in Singapore, Hong Kong, India, Israel and Liechtenstein for safe-keeping. In parallel, there has been a massive influx of foreign funds into Switzerland from Eurozone peripheral -- Club Med -- countries including Greece, Spain, Italy and Portugal as the Eurozone crisis heats up. As a result of this two way massive out-flow and in-flow of funds, the quantum of total foreign assets managed by Swiss banks has dipped by a mere SFr 300 billion since 2008, when the total assets of foreign clients stood at about 3 trillion Swiss francs or 3,000 billion Swiss francs. Had it not been for the Eurozone crisis, the quantum of decline in overseas funds under management in Swiss banks would have shown a much more dramatic decline. [ATCA Ref: 2]

Asymmetric threats to Swiss banking

1. The primary concern expressed by top investors is the capacity of the Swiss National Bank to be able to mount a rescue of its extremely large top-tier Swiss banks, if they were to get into trouble in another global financial crisis. The total banking liabilities of Swiss banks are several hundred per cent of the GDP of the entire country, which is a remarkably similar profile to Ireland prior to the 2007-08 crisis, if not Iceland.

2. Maintaining the relationship of the Swiss Franc at 1.20 with the euro is likely to cause further chaos as the value of the euro continues to decline against major currencies and the Swiss National Bank (SNB) continues to print tens of billions of Swiss Francs every month to hold the value of the currency down in parallel with the euro's step-by-step plunge. This could cause a sudden and massive decline in the value of the Swiss franc given that it is traded in a relatively thin market compared to euro-dollar or sterling-dollar both of which are traded in trillion plus volume daily.

3. The Swiss National Bank (SNB) policy of associating the hitherto "safe-haven" Swiss Franc with a fast-falling currency like the euro may yet cause unprecedented dramatic losses. This in turn may force the Swiss central bank to relinquish their self-imposed peg to the euro, which could severely impact the general confidence of investors in its stewardship, skill-sets and specifically the interlinked ephemeral confidence in the solidity of Swiss banks.

4. As the ephemeral and somewhat fragile "safe haven" confidence in the Swiss franc suddenly fractures, the consequences may include a dramatic decline in the value of the Swiss franc against a basket of major currencies. If this were to be in double digit percentages and be coupled with a parallel decline in the ratings of Swiss banks, this could lead to a "step-loss" in perception amongst serious investors that Switzerland is indeed a "safe-haven". The cascading chain reaction would have multiple interlinked consequences, chief amongst which may be a large-scale and unprecedented exodus of funds not just out of Switzerland but out of Swiss banks regardless of jurisdiction.

5. Now that the confidential data of 10,000 Swiss bank employees and former members of staff has been handed over to the US tax authorities along with correspondence, it is only a matter of time before summons are issued against some of those present and former Swiss bankers. The consequences of issuing those summons is well understood in the context of Wegelin bank, the oldest private bank in Switzerland. Wegelin collapsed under the weight of legal proceedings issued in New York against senior executives and the simultaneous outflow of more than four billion Swiss francs in deposits-held as confidence ebbed away swiftly in January this year. [ATCA Ref: 1, 5]

How to preserve Switzerland's standing as a global private banking hub?

Noting the Swiss banking centre continues to face major challenges, the Swiss Bankers Association (SBA) says a greater focus is now required to tap additional growth opportunities. This in turn would need "both political and regulatory improvements and better cooperation between authorities and the institutions being supervised in the interests of the banking centre... the main issue here is to further strengthen the innovative power of Swiss asset management so as to be able to continually come up with new ideas and products that are also attractive for foreign retail and institutional investors." The SBA also called for steps to tap into "the dramatic growth in the economies and levels of wealth in emerging markets and particular client segments (such as the opportunities arising with high net worth clients with assets of more than 100 million Swiss francs)".

Conclusion

Throughout most of the 20th century and up until recently in the 21st century, Swiss banking appears to have operated with two broad comparative advantages:

1st: Client privacy and confidentiality achieved through tight banking secrecy laws; and

2nd: General banking and asset management expertise, including excellence in risk management. [ATCA Ref: 3]

Both those comparative advantages appear to have been partially surrendered by Swiss banks through quasi-self-inflicted wounds. In parallel, the US and European powers -- especially Germany and France -- seem to be engineering the total elimination of the 1st comparative advantage of Switzerland step-by-step. At the same time, Europe is undergoing a massive financial crisis because of its single currency which could further test the resilience of Switzerland and the Swiss franc, quickly unravelling vast sums of money and undermining its 2nd comparative advantage completely. [ATCA Ref: 4]

Key Question

Given what Switzerland stands for is nothing new, why are the Western powers obsessing on the Swiss banking industry?

ATCA 5000 References

1. What Really Happened To The Oldest Bank in Switzerland? Wegelin: Death Throes of Swiss Banking Secrecy & Asymmetric Risk to Swiss Banks - 1st Feb 2012;

2. Eleven Offshore Banks On The US Radar: What Happens Next To Swiss-Based Private Banking? - 12th Feb 2012;

3. Switzerland's New Controls for Runaway Alternative Investments, Shadow Banking & Tax Avoidance Schemes? - 15th April 2012;

4. Switzerland: The End of Banking Secrecy? Comment & Interview - 3rd May 2012; and

5. Swiss Banking Saga Takes Another Surreal Twist? - 1st July 2012.

[STOPS]

What are your thoughts, observations and views? We are hosting an Expert roundtable on this issue at ATCA 24/7 on Yammer.

[ENDS]

Expert Roundtables

Expert roundtables are the newly launched ATCA 24/7 Q&A private exclusive club service. They seek to become the killer application in strategic intelligence by delivering an unprecedented competitive advantage to our distinguished members. They can only be accessed online at https://www.yammer.com/atca

Q1: How to become a privileged member of ATCA 24/7 to participate in the expert roundtables?

A1: i. If you are a distinguished member of ATCA 5000, ATCA Open, The Philanthropia or HQR affiliated groups you may be allowed to become a privileged member of this new and exclusive private club.

ii. If you are pre-invited, visit the private intelligence network -- PIN -- by going to https://www.yammer.com/atca [Note: In https:// 's' is for security and encryption]

iii. If you don't have membership of the PIN yet, email the mi2g Intelligence Unit at intelligence.unit at mi2g dot com for an exclusive invitation.

Q2: How to participate in the expert roundtables and get domain-specific strategic intelligence questions answered?

A2: Access the ATCA 24/7 Private Intelligence Network -- PIN -- online and ask or answer a strategic intelligence question, no matter how complex. Receive expert answers within 24 hours or get pointers from:

i. ATCA 5000 experts who are online;

ii. ATCA Research and Analysis Wing; and

iii. mi2g Intelligence Unit.

Q3: Why is the ATCA 24/7 Q&A Exclusive Club special?

A3: ATCA 24/7 has now created an exclusive private intelligence watering hole and expert roundtable at the highest level where interesting and sophisticated questions are being asked from around the world, and intelligent answers are being provided, almost always by experts who have deep domain-specific knowledge. Come and check out the exclusive club, take it for a strategic test drive, which sign-of-intelligent life are you waiting for?

To learn more about "The Expert Roundtable: ATCA 24/7 Q&A Club" email: intelligence.unit at mi2g.com and if you are already a member visit https://www.yammer.com/atca

We welcome your thoughts, observations and views. To reflect further on this subject and others, please respond within Twitter, Facebook and LinkedIn's ATCA Open and related discussion platform of HQR. Should you wish to connect directly with real time Twitter feeds, please click as appropriate:

. ATCA Open

. @G140

. mi2g Intelligence Unit

. Open HQR

. DK Matai

Best wishes