Is It 1937 All Over Again?

London, UK - 14th August 2011, 00:28 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors are not necessarily representative of the views of ATCA, which is neutral. ATCA conducts collective Socratic dialogue on global opportunities and threats.]

Have global events begun to look and sound too familiar in 2011 to a previous era in the 1930s? In 1937, economic conditions were surprisingly similar to those at present. Commodity prices were rising, people worried about inflation and deficits, and so they acted -- and paid the price. Many who remember history ask: how does the recent stall in major economies compare to 1937? At that time, the US economy had been growing rapidly for three years, thanks in large part to government stimulus programs aimed at ending the deep recession that began in 1929. This gave US policy makers every reason to believe the economy was strong enough to withdraw government stimulus. Much like 2011, the US Congress insisted on cutbacks to government spending in 1937 and passed laws to balance the budget because President Roosevelt’s policies had cost a bundle and opened a big budget deficit.

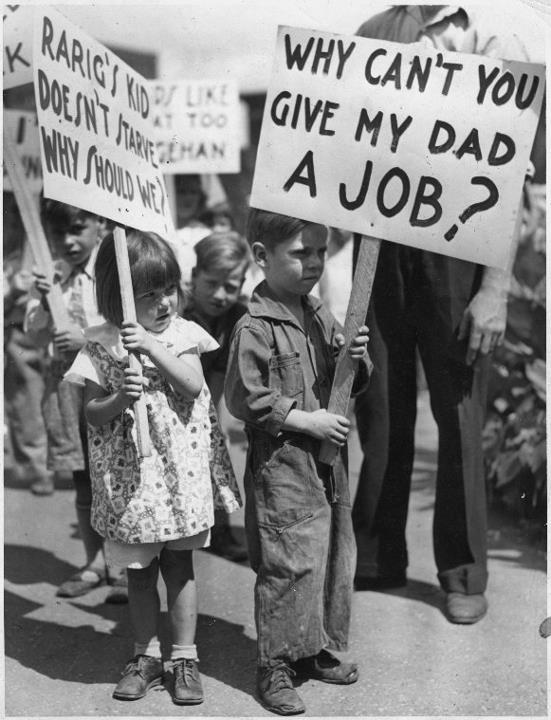

Children holding signs at a picket line in 1937

Children holding signs at a picket line in 1937

As a result of the newly introduced austerity measures:

1. Confidence shook and fell rapidly, a problem worsened by extreme volatility in financial markets, which added to the woes of a double dip recession. The budget cuts knocked the economy into a tailspin and it relapsed into the second phase of the Great Depression.

2. The stock market collapsed. In a few months, the Dow Jones industrial average dropped 48 percent from its peak in 1937. It kept on falling so steeply that it:

a. Undermined confidence;

b. Brought back painful memories of the twin financial crashes of 1929 and 1932; and

c. Wiped out the wealth effect of rising prices.

3. US annual GDP fell back more than three percent in 1938.

4. US industrial production fell by nearly 40 percent, this time a much steeper decline than in 1929-33.

5. Unemployment, which had slowly dropped to a still-depressing 14 percent, from a peak of 25 percent in the early 1930s, soared by a further 4 million to nearly 20 percent once again.

6. Price declines swiftly led to deflation.

7. Not long after that came the build up towards the Second World War.

8. Real growth in employment, manufacturing output, financial markets and GDP returned only when the government launched the massive spending -- and budget deficits -- required to win the Second World War.

In 1937, the economy was getting on its feet after the calamity of the Depression. Did the policy makers move too quickly in 1937 as they may have done in 2011 to withdraw government support for the US economy? In the long run, the budget deficits were and are still, clearly not sustainable. However, as FDR’s closest aide Harry Hopkins famously said, “People don’t eat in the long run; they eat every day!” And today’s approach, if 1937 is a guide, could create not only more suffering but also less prosperity. In order to grow, the economy needs people who eat, people who work, people who produce and people, as well as businesses, that contribute to the Treasury by paying taxes.

The Federal Reserve did its part to throw the US economy back into recession by tightening credit. Wholesale prices were rising in 1936, setting off inflation fears. There was concern that the Fed’s easy monetary policies of the 1920s had led to asset speculation that precipitated the 1929 crash and ensuing Great Depression. The Fed responded by doubling banks' reserve requirements between August 1936 and May 1937, in several stages, leading to a sharp contraction in the money supply.

Then as now, policy makers were struggling with how and when to turn off the fiscal stimulus and monetary easing that had been used to combat the initial crisis. Does this sequence of events suggest that we are facing similar risks today not just in the US but also in Europe? Is there a possibility that the United States and certain European nations could face a recession possibly as bad as the contraction in 1937-38? Squeezed in the middle are tens of millions of unemployed, hundreds of millions of investors in financial markets, and billions of people the world over who depend on demand generated by consumption and physical investment.

Conclusion

Are we preparing for the 75th anniversary of the Great Depression’s double dip in 1937-38 by inadvertently concocting a second wave of the financial crisis within The Great Unwind in 2011-12? With 20/20 hindsight, the mistake of 1937 was a pre-emptive policy tightening in a fragile economic environment.

The most damaging outcome of the 1930s was the collapse of investor confidence and its effect on raising new capital for businesses. That destruction of wealth had profound and long-lasting repercussions for the markets lasting more than two decades. No one was interested in investing in a new issue of stocks or new bonds as long as the untrustworthy Wall Street underwriters were involved. On the face of it, the financial crisis began in 1929 and lasted a decade, until the outbreak of the Second World War in 1939. But the lingering effects of that crisis lasted until the Korean War in the early 1950s and the early years of Eisenhower's presidency which began in 1953.

In 2011, investor confidence in the stock market has once again been badly shaken while the market for quality sovereign bonds has benefited. This is where the parallels between the 1930s crisis and today's crisis become unsettling. Future growth in all sectors of the economy ultimately depends on investors and their willingness to invest in risky assets like equities and corporate bonds. The exact reverse appears to be happening at present if one witnesses investors' votes on this crisis manifest via:

1. Sharply declining government bond yields of top sovereigns;

2. Rapidly declining and volatile financial markets; and

3. The high price of precious metals like gold and silver.

Ultimately, market volatility impoverishes more investors than it enriches: it just scares them away when they are needed most! Is the people’s disenchantment with the incumbent political leadership, weak governance mechanisms, and the steep decline in the global financial markets telling us that the extreme austerity measures may not be the most appropriate medicine at this stage of the economic cycle?

[STOPS]

We are hosting an Expert roundtable on this issue at ATCA 24/7 on Yammer.

[ENDS]

Expert Roundtables

Expert roundtables are the newly launched ATCA 24/7 Q&A private exclusive club service. They seek to become the killer application in strategic intelligence by delivering an unprecedented competitive advantage to our distinguished members. They can only be accessed online at https://www.yammer.com/atca

Q1: How to become a privileged member of ATCA 24/7 to participate in the expert roundtables?

A1: i. If you are a distinguished member of ATCA 5000, ATCA Open, The Philanthropia or HQR affiliated groups you may be allowed to become a privileged member of this new and exclusive private club.

ii. If you are pre-invited, visit the private intelligence network -- PIN -- by going to https://www.yammer.com/atca [Note: In https:// 's' is for security and encryption]

iii. If you don't have membership of the PIN yet, email the mi2g Intelligence Unit at intelligence.unit at mi2g dot com for an exclusive invitation.

Q2: How to participate in the expert roundtables and get domain-specific strategic intelligence questions answered?

A2: Access the ATCA 24/7 Private Intelligence Network -- PIN -- online and ask or answer a strategic intelligence question, no matter how complex. Receive expert answers within 24 hours or get pointers from:

i. ATCA 5000 experts who are online;

ii. ATCA Research and Analysis Wing; and

iii. mi2g Intelligence Unit.

Q3: Why is the ATCA 24/7 Q&A Exclusive Club special?

A3: ATCA 24/7 has now created an exclusive private intelligence watering hole and expert roundtable at the highest level where interesting and sophisticated questions are being asked from around the world, and intelligent answers are being provided, almost always by experts who have deep domain-specific knowledge. Come and check out the exclusive club, take it for a strategic test drive, which sign-of-intelligent life are you waiting for?

To learn more about "The Expert Roundtable: ATCA 24/7 Q&A Club" email: intelligence.unit at mi2g.com and if you are already a member visit https://www.yammer.com/atca

We welcome your thoughts, observations and views. To reflect further on this subject and others, please respond within Twitter, Facebook and LinkedIn's ATCA Open and related discussion platform of HQR. Should you wish to connect directly with real time Twitter feeds, please click as appropriate:

. ATCA Open

. @G140

. mi2g Intelligence Unit

. Open HQR

. DK Matai

Best wishes