QE3: What are The Implications of Critical Warnings To Bernanke?

London, UK - 21st September 2011, 13:40 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors are not necessarily representative of the views of ATCA, which is neutral. ATCA conducts collective Socratic dialogue on global opportunities and threats.]

Top Republican lawmakers in both chambers of Congress have warned Federal Reserve Chairman Ben Bernanke to refrain from “further extraordinary intervention” or additional quantitative easing after today's meeting of the Federal Open Market Committee (FOMC). Questioning the efficacy of the first two rounds of monetary easing:

1. Speaker of the House John Boehner (R-OH);

2. Senate Majority Leader Mitch McConnell (R-KY);

3. House Majority Leader Eric Cantor (R-VA); and

4. Senate Minority Whip Jon Kyl (R-AZ)

said they are concerned another round of QE could "exacerbate current problems or further harm the US economy" and they have reason to be “skeptical” of his plans. The senators and congressmen have asked that a copy of their letter be shared with each member of the FOMC. The joint letter demonstrates the pressure Bernanke is facing from the Grand Old Party (GOP) as the Fed considers how best to try to bolster economic growth with additional monetary stimulus. Senator Charles Schumer (D-NY) in a statement called the letter “a heavy-handed attempt to meddle in the Fed’s independent stewardship of monetary policy” and said it should be “ignored by chairman Bernanke and the Fed’s policy makers.”

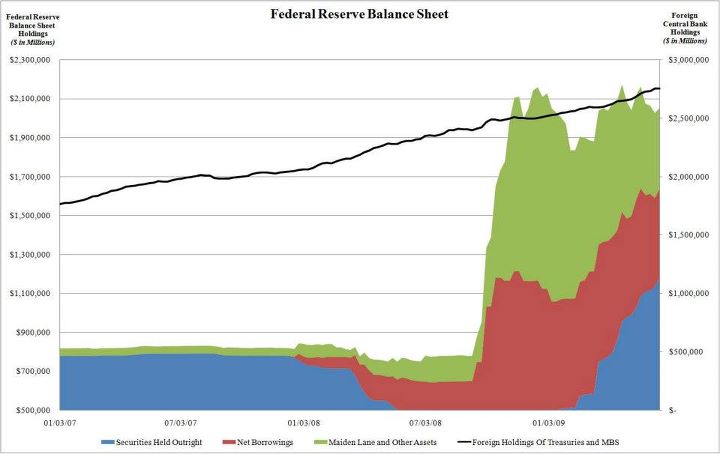

Federal Reserve Balance Sheet

Federal Reserve Balance Sheet

Behind the curtains, there are significant pressures piling up on chairman Bernanke from both parties within the Congress. Not just the Republicans, but even within the Democrat ranks, there is a growing view that QE2 was clearly beneficial to Wall Street but harmful to the wider population of Main Street.

Here's the full letter:

Dear Chairman Bernanke,

It is our understanding that the Board Members of the Federal Reserve will meet later this week to consider additional monetary stimulus proposals. We write to express our reservations about any such measures. Respectfully, we submit that the board should resist further extraordinary intervention in the U.S. economy, particularly without a clear articulation of the goals of such a policy, direction for success, ample data proving a case for economic action and quantifiable benefits to the American people.

It is not clear that the recent round of quantitative easing undertaken by the Federal Reserve has facilitated economic growth or reduced the unemployment rate. To the contrary, there has been significant concern expressed by Federal Reserve Board Members, academics, business leaders, Members of Congress and the public. Although the goal of quantitative easing was, in part, to stabilize the price level against deflationary fears, the Federal Reserve’s actions have likely led to more fluctuations and uncertainty in our already weak economy.

We have serious concerns that further intervention by the Federal Reserve could exacerbate current problems or further harm the U.S. economy. Such steps may erode the already weakened U.S. dollar or promote more borrowing by overleveraged consumers. To date, we have seen no evidence that further monetary stimulus will create jobs or provide a sustainable path towards economic recovery.

Ultimately, the American economy is driven by the confidence of consumers and investors and the innovations of its workers. The American people have reason to be skeptical of the Federal Reserve vastly increasing its role in the economy if measurable outcomes cannot be demonstrated.

We respectfully request that a copy of this letter be shared with each Member of the Board.

Sincerely

Senator Mitch McConnell, Rep. John Boehner, Sen. Jon Kyl, Rep. Eric Cantor

Operation Twist

The Federal Open Market Committee will probably announce it has decided to replace short-term Treasuries in its $1.65 trillion portfolio with long-term bonds. This would be the resurrection of a move it undertook in the 1960s known as Operation Twist. If executed, it would be the third bond-buying program the Fed has launched since November 2008. The net effect would be to twist the so-called yield curve, meaning lowering the level of longer-term interest rates versus short-term rates. In theory, by adding to demand for longer-term Treasury bonds, the Fed could pull those rates down further. That could translate into lower rates on corporate, municipal and mortgage bonds. However, even without Operation Twist, the yield on the 10-year Treasury note already fell to a record low this month on concerns global growth is flagging and Europe’s sovereign-debt crisis will intensify. It is highly likely that the Fed will NOT print new money to fund its purchases. This would allow the Fed to counter the GOP letter because it isn’t engaging in a so-called third round of Quantitative Easing or QE3 -- pumping more money into the financial system -- and therefore the Fed could argue that bond purchases would not threaten to stoke inflation.

Key Questions

1. As long term US Treasury yields tend towards 1.5% for 10 years and 2.75% for 30 years, does that suggest the onset of protracted deflation or inflation?

2. What happens when massive debt deleveraging takes place? Does one get hyper-inflation or protracted deflation? Where does gold fit in all of this?

3. How does lowering long term interest rates ad infinitum via QE3, QE4, QE5... help to restore lost confidence, generate demand and bring back trust in financial services?

4. If there is no restoration in confidence and demand, could interest rates go towards 0% in the long term and yet there would be no tangible economic growth?

5. As long terms yields on quality assets like US Treasuries fall, does that not incentivise investors to become more speculative and move their allocation to different asset classes, pushing up inflation? Is inflation a credible way out of this morass?

[STOPS]

We are hosting an Expert roundtable on this issue at ATCA 24/7 on Yammer.

[ENDS]

Expert Roundtables

Expert roundtables are the newly launched ATCA 24/7 Q&A private exclusive club service. They seek to become the killer application in strategic intelligence by delivering an unprecedented competitive advantage to our distinguished members. They can only be accessed online at https://www.yammer.com/atca

Q1: How to become a privileged member of ATCA 24/7 to participate in the expert roundtables?

A1: i. If you are a distinguished member of ATCA 5000, ATCA Open, The Philanthropia or HQR affiliated groups you may be allowed to become a privileged member of this new and exclusive private club.

ii. If you are pre-invited, visit the private intelligence network -- PIN -- by going to https://www.yammer.com/atca [Note: In https:// 's' is for security and encryption]

iii. If you don't have membership of the PIN yet, email the mi2g Intelligence Unit at intelligence.unit at mi2g dot com for an exclusive invitation.

Q2: How to participate in the expert roundtables and get domain-specific strategic intelligence questions answered?

A2: Access the ATCA 24/7 Private Intelligence Network -- PIN -- online and ask or answer a strategic intelligence question, no matter how complex. Receive expert answers within 24 hours or get pointers from:

i. ATCA 5000 experts who are online;

ii. ATCA Research and Analysis Wing; and

iii. mi2g Intelligence Unit.

Q3: Why is the ATCA 24/7 Q&A Exclusive Club special?

A3: ATCA 24/7 has now created an exclusive private intelligence watering hole and expert roundtable at the highest level where interesting and sophisticated questions are being asked from around the world, and intelligent answers are being provided, almost always by experts who have deep domain-specific knowledge. Come and check out the exclusive club, take it for a strategic test drive, which sign-of-intelligent life are you waiting for?

To learn more about "The Expert Roundtable: ATCA 24/7 Q&A Club" email: intelligence.unit at mi2g.com and if you are already a member visit https://www.yammer.com/atca

We welcome your thoughts, observations and views. To reflect further on this subject and others, please respond within Twitter, Facebook and LinkedIn's ATCA Open and related discussion platform of HQR. Should you wish to connect directly with real time Twitter feeds, please click as appropriate:

. ATCA Open

. @G140

. mi2g Intelligence Unit

. Open HQR

. DK Matai

Best wishes