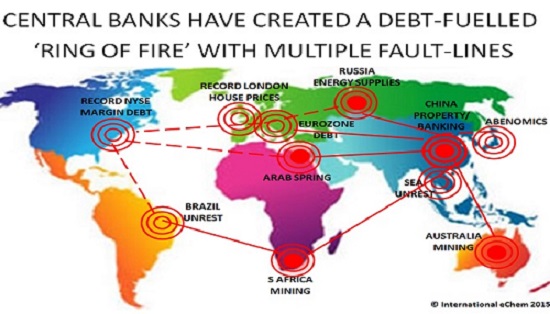

Why's China-Crisis Going Global? $200 Trillion Debt-Fuelled Ring of Fire With Multiple Fault Lines

London, UK - 26th August 2015, 14:00 GMT

1. “There are two ways to conquer and enslave a country. One is by the sword. The other is by debt,” recorded John Adams, the second president of the United States.

2. McKinsey Institute found earlier in 2015 that global debt is $199 trillion and getting more and more unsustainable. Since then global debt has continued to increase and will be significantly north of $200 trillion at this stage.

$200 Trillion Debt-Fuelled Ring of Fire With Multiple Fault Lines

$200 Trillion Debt-Fuelled Ring of Fire With Multiple Fault Lines

3. This extremely high level of global debt poses new risks to financial stability and may undermine global economic growth not just in China but also in developed countries and emerging markets.

4. Putting it another way, if the global population is 7.3 billion, total global debt is $27,204 for every person living today. How manageable is that?

5. What is even more disconcerting is that this debt report ignored US unfunded liabilities of over $100 trillion.

6. Not just the US, but all major economies have “higher levels of borrowing relative to GDP” than in 2007. However, in China the government, household and total debt has increased a staggering four-fold since 2007. This is part of the reason why China is the most vulnerable to slowing economic growth, which exacerbates the capability to service debt.

7. Almost 29% of that debt – $57 trillion – has been accumulated in the relative short period since the financial crisis erupted in 2007 – just 8 years.

8. What are the risk areas caused by these bloated, unsustainable levels of debt that have been accumulated globally and the consequences when interest rates either begin to rise or are forced to rise again?

9. What is the major cause of extremely risky, unprecedented debt levels? Quantitative Easing (QE) in trillions and ultra loose monetary policies whose dangerous consequences remain unacknowledged.

10. What is the core risk associated with a new global financial crisis? Currency wars and devaluations; uncertainty; high volatility; loss of confidence; massive deflation that destroys consumption, investment and capability to service debt; bank bail-ins as opposed to bail-outs; and wealth taxes.

What the China crisis is doing is exposing the problem of unmanageable debt and once that fault line is exposed other global fault lines including those of the US and European high levels of debt will also get exposed causing a potential sharp descent into another global financial crisis. On this occasion, the central bankers will have few levers left to fight deflation and to deal with the inability of individuals, corporations and governments to service debt as growth slows down significantly.

Read the full briefing here: http://ow.ly/RohH0

[STOPS]

Source: QiLabs.net 1. Funding Form 2. Involvement Form 3. iQ:Ei Club

What are your thoughts, observations and views? We are keen to listen and to learn.

Best wishes

D K Matai

ATCA: The Asymmetric Threats

Contingency Alliance is a philanthropic expert initiative founded

in 2001 to resolve complex global challenges through collective

Socratic dialogue and joint executive action to build a wisdom

based global economy. Adhering to the doctrine of non-violence,

ATCA addresses asymmetric threats and social opportunities arising

from climate chaos and the environment; radical poverty and microfinance;

geo-politics and energy; organised crime & extremism; advanced

technologies -- bio, info, nano, robo & AI; demographic skews

and resource shortages; pandemics; financial systems and systemic

risk; as well as transhumanism and ethics. Present membership

of ATCA is by invitation only and has over 5,000 distinguished

members from over 120 countries: including 1,000 Parliamentarians;

1,500 Chairmen and CEOs of corporations; 1,000 Heads of NGOs;

750 Directors at Academic Centres of Excellence; 500 Inventors

and Original thinkers; as well as 250 Editors-in-Chief of major

media.

The Philanthropia, founded in 2005, brings together over

1,000 leading individual and private philanthropists, family offices,

foundations, private banks, non-governmental organisations and

specialist advisors to address complex global challenges such

as countering climate chaos, reducing radical poverty and developing

global leadership for the younger generation through the appliance

of science and technology, leveraging acumen and finance, as well

as encouraging collaboration with a strong commitment to ethics.

Philanthropia emphasises multi-faith spiritual values: introspection,

healthy living and ecology. Philanthropia Targets: Countering

climate chaos and carbon neutrality; Eliminating radical poverty

-- through micro-credit schemes, empowerment of women and more

responsible capitalism; Leadership for the Younger Generation;

and Corporate and social responsibility.